Cash For Lawsuits offers Fast, Reliable and Hassle-Free

Pre Settlement Funding at Competitively Low Use-Fees

Pre Settlement Funding at Competitively Low Use-Fees

Legal claims such as Personal Injury Lawsuits can be a lengthy process leading to frustration as many Plaintiffs are forced to accept a lower than expected settlement due to the time it takes for a case to settle. If you are forced out of work during the pendency of your case, you may experience difficulty managing your finances for basic life-needs. Cash For Lawsuits understands your circumstances and we can assist by providing a Pre Settlement Advance to help bridge the gap until you successfully settle your case.

Pre Settlement Funding For Plaintiffs

Cash For Lawsuits provides pre settlement funding to plaintiffs with pending legal cases due to personal injury, medical malpractice, wrongful termination and many other case types. Pre settlement funding provides the lawsuit cash advance you expect to receive from a successful legal claim. Cash For Lawsuits legal funding is a non-recourse form of lawsuit funding, meaning if you were to lose your case, you owe us nothing in return. The only time repayment is required is after you have won and received your settlement or reached a positive settlement out of the courtroom.

Pre settlement loans from Cash For Lawsuits can fuel your financial position by providing the means to pay medical expenses and bills while your law firm can continue to fight for you and come out victorious. Insurance companies are often the ones that will ultimately be paying settlement to a plaintiff and they will exhaust all legal measures possible to extend a case as long as possible in hopes that the plaintiff will settle early and often for much less. We can help get you pre settlement funding on your projected settlement so that you can take the time you need to let your attorney work for you, landing the settlement you deserve and not succumbing to the deep pockets of the insurance companies.

What Separates Cash For Lawsuits?

Cash For Lawsuits is uniquely positioned among lawsuit funding companies.

Direct Funder of Non-Recourse Advances

Cash For Lawsuits is a direct funding source, offering a vast array of products to help satisfy a Plaintiff’s life needs. We are not a broker and have the capability to fund your case “in-house.”

Non-Recourse Lawsuit Funding

At Cash For Lawsuits, we offer our clients Non-Recourse lawsuit funding, which means if you lose your case, you owe Cash For Lawsuits nothing.

Low Use-Fees

Cash For Lawsuits offers competitively low Use-Fees for both Plaintiffs and Attorneys, which in most instances can be funded in as little as 24-48 hours.

Lawsuit Financing: Cases We Fund

Attorney Financing

Breach of Contract

Class Action

Commercial Litigation

Discrimination

Divorce

Employment Disputes

Medical Malpractice

Motor Vehicle Accident

Negligence / Personal Injury

Police Brutality

Premises Liability

Products Liability

Slip and Fall

Sexual Harassment

Workers’ Compensation

Wrongful Arrest

Wrongful Death

Wrongful Termination

1. EACH ADVANCE IS WITH NO-RECOURSE — PAY ONLY IF YOU WIN OR SETTLE YOUR CASE

2. NO CREDIT CHECKS

3. COMPETITIVE FEES

4. FUNDING ALL PERSONAL AND WORK-RELATED CASES

or call 1-800-495-2274

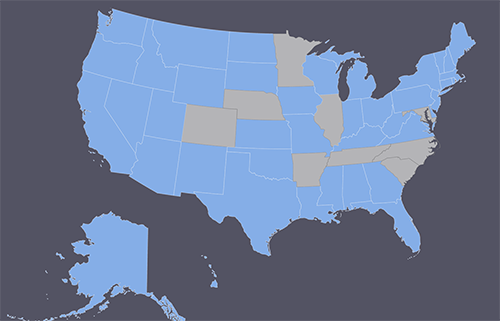

Lawsuit Settlement Funding: States We Fund In

Cash For Lawsuits provides customized Lawsuit Cash Advances throughout the country* to Plaintiffs involved in a Personal Injury Lawsuit or Claim. Our Pre-Settlement Cash Advances are a Non-Recourse Advance against the future proceeds of your pending personal injury claim.

* Due to state restrictions, we do not provide Pre-Settlement Funding in AR, CO, IL, IN, KY, MD, MN, MO, NC, NE, NV, SC, TN, VT & WV.

or call 1-800-495-2274

How Lawsuit Funding Helps Plaintiffs

Like most things financial in nature, lawsuit loans have drawbacks and advantages and it all really depends on the plaintiff’s legal and personal situations. Understanding how legal funding works, how different lawsuit funding companies operate and how it applies to your situation levels the playing field and helps you to make an informed decision. Cash For Lawsuits strives to reduce the complexity for our clients.

No Limitations on Spending

Regardless what type of case a plaintiff may have, when they apply for and receive legal funding, they are not restricted on how they spend that money.

They are free to use it to cover medical payments, mortgage payments, rent or household bills. They can use it for family expenses or just to alleviate the pressures they are feeling financially from their case.

Often times, a personal injury plaintiff is out of work due to injury and not able to earn a paycheck. Lawsuit funding can be a relief that creates a windfall to tide them over until their case can settle or they can return to work.

Breathing Easier

Injured, out of work, medical expenses due to an accident, bills growing and debt mounting can all be stressful and wear on the strongest person. Cash For Lawsuits wants to help through the issuance of our Lawsuit Cash Advances. By providing much needed financial relief, our clients can breathe easier, relieve the financial burdens and get themselves back on their feet. Sometimes, having the reassurance that you are back in control is worth any costs associated with it.

Lose, Owe Nothing

Quite simply, should you lose your case and not receive your expected settlement, you will owe Cash For Lawsuits nothing because our funding methods are non-recourse. In the case when our clients do win their lawsuit, the amount they owe us in return for their advance is paid by their lawyer from their settlement.

Fending Off Early Settlement Pressure From Insurance Companies

The unfortunate circumstance is that insurance companies are often the ones that will be paying out your settlement and they will exhaust all measures within the legal process to extend your case as long as they can in hopes that you will cave and agree to a lesser cash settlement.

Enter Cash For Lawsuits. We can help get you a lawsuit advance on your projected settlement so that you can take the time you need to let your attorney work for you, landing the settlement you deserve and not succumbing to the deep pockets of the insurance companies and employers.

Easy, Straight Forward, Expedited Process

The application process is easy, fast and requires very little personal information at all – mostly contact type information such as name and phone number. Once submitted, the lawsuit funding company will work with your attorney to detail your case and determine if you are approved or not. Assuming the lawyer cooperates, once approved, funding can be distributed quickly, often reaching plaintiffs in 24 hours or less.

No Background Checks, Credit Scores or Employment History Needed

Lawsuits loans, settlement loans and pre-settlement lawsuit loans often times may require extensive personal checks and validation. A loan requires some sort of collateral, and often a bank or other financial institution needs to perform their due diligence to make sure the borrower has the backing to repay it. Because lawsuit funding is not a loan, Cash For Lawsuits does not require any employment checks, background checks or credit score analysis. The facts of your case provide the only background needed to determine a fair cash advance amount.

FAQs About Lawsuit Funding

Why doesn’t Cash For Lawsuits issue lawsuit loans?

Cash For Lawsuits merely prefers to issue lawsuit cash advances due to the advantageous nature of this legal funding type. In particular, should a plaintiff lose their case, they do not owe repayment like they may on a lawsuit loan.

Can I obtain a settlement loan from my attorney?

While you should consult with your lawyer prior to applying for a settlement loan, it may be considered unethical for your attorney to loan you pre settlement funds. Your lawyer will most likely be needed if you do apply as they would need to work with the lawsuit funding company to provide details of your pending lawsuit.

How do I know if I qualify for legal funding?

For most outstanding cases, pre settlement funding is a possibility, but limitations do exist by state. The amount of the pre settlement loan you can take will be determined by the likelihood of your case settling in your favor, the extent of your injuries and the type of treatment you have received to date. Contact Cash For Lawsuits and we can review your unique circumstances.

How can I receive my pre settlement funding?

Funds can be distributed in a number of methods including checks and wires. Your lawsuit funding company can walk you through the funding process and their specific requirements.

What is a lawsuit funding company?

Lawsuit funding companies are referred to by different names and offer products aimed at helping individual plaintiffs that may be facing personal injury cases, accident cases and or other pending legal settlements. These companies provide funding in the form of lawsuit loans, settlement loans and lawsuit cash advances.

Why are lawsuit cash advances considered risk-free?

Lawsuit cash advances are considered risk-free for plaintiffs because they require no repayment should the plaintiff fail to win their pending legal case. As a result, the issuer carries the risk.

Lawsuit Loans or Lawsuit Cash Advance?

Often referred to publicly as pre settlement lawsuit loans or simply lawsuit loans, pre-settlement funding is not limited to this sole form of legal funding. As a matter of fact, Cash For Lawsuits prefers to administer a more flexible form known as lawsuit cash advances. While a lawsuit loan may charge high interest rates, periodic interest payments and repayment of principal prior to the completion of your case, a lawsuit cash advance does not carry the same requirements. As mentioned above, this lawsuit funding is non-recourse meaning all risk falls to the lawsuit funding companies and not the plaintiff. Should the plaintiff lose, they owe nothing. In addition, you will not make interest payments or principal repayment until your attorney has won your case and you have received your settlement payment.

Both lawsuit loans and lawsuit cash advances can be used to fund various case types including personal injury loans, car accident loans, premises liability and more. Regardless of case, Cash For Lawsuits can provide comparisons of pre settlement lawsuit loans from competitors and detail the advantages that a lawsuit cash advance can provide. Each situation is unique and each individual has unique needs, let Cash For Lawsuits assist you in making the best choice for your unique circumstance so we can advance the funds you need to satisfy your outstanding bills.

How Do I Qualify for a Settlement Loan or Lawsuit Settlement Funding?

Qualifying for a settlement loan or other lawsuit funding all starts with your case. Specifically:

1. The type of case, whether the state prohibits legal funding for that case type and whether the lawsuit funding company will underwrite it.

2. The strength of your case and the likelihood you will prevail.

3. The point at which your case currently stands – is it new or nearing an end – this will determine not only your likelihood of winning, but also produce more detail and documents that will assist in determining the potential settlement payout amount.

4. The attorneys or lawyers you have defending the case and their willingness to cooperate with the legal funding company.

Give us a call at Cash For Lawsuits and we can determine whether you qualify in as little as 5 minutes.

Settlement Loan approval

When you apply, your application will be assessed and every case can be different. Cash For Lawsuits knows that you need money now and we respect that, so when an application comes into us, we assess it immediately and start our underwriting process. Once we have reached your attorney and they provide the necessary information and documents, our relationship manager will turn over the case to our underwriting department who will set into motion the process that will determine whether your application is approved and you are granted plaintiff funding. The amount will depend on your case size.

Your Attorney’s Role

Cash For Lawsuits cannot stress enough to applicants the critical role that attorneys play in the approval process. Without their cooperation and attention to detail, the underwriting process cannot be successfully completed. The sooner they respond, the sooner plaintiffs can be provided their pre settlement funding. Be sure to discuss your financial needs and situation with your lawyer prior to applying.

Cost of Legal Funding

When a plaintiff takes a lawsuit loan or pre-settlement loan, the costs associated with it will be subtracted from their settlement funds. Meanwhile, a large benefit of lawsuit cash advances is their non-recourse structure, meaning any repayment or fees are only paid if a case is won. As a result, they are not treated like standard loans are treated as repayment is not always required or guaranteed to take place.

Before taking a lawsuit advance or selecting a legal funding company, be aware of some of the following items including high, compounding interest rates, up front fees and other expenses that you may incur.

Timing Your Settlement Funding Reduces Costs

They say timing is everything. While medical expenses can come due and you may be injured and out of work, failing to first leverage savings and other methods to obtain funding for these expenses before applying for lawsuit advances can prove costly. The longer a plaintiff has an outstanding settlement funding balance, the higher the likely costs will be due to interest or other fees. Be sure you absolutely need the money when you apply.

Settlement Loans Can Carry High Expenses

A settlement loan can carry excessive costs including fees and high interest rates. Cash For Lawsuits has competitively low-use fees and we are upfront about how it will be repaid and when you might be obligated to repay your lawsuit cash advance. When contemplating a lawsuit advance you would be wise to keep an eye out for:

a. Companies that are unwilling to provide a clear fee or interest structure

b. Large upfront fees or origination fees

c. Compounding interest and frequency of interest payments

d. Failure to produce clear, written and signed agreements

Be Aware Of Upfront Fees

If a lawsuit cash advance company charges up-front fees, take note of this cost and ask to see a payoff schedule and the estimated total repayment amount. Question the up-front fees and whether they have any compounding interest associated with them.

Compound or Simple Interest

Be aware of the interest structure on your lawsuit loan – is it compounding monthly? If so, depending on the length for which you have the loan, you may pay upwards of 100% interest within the course of as little as two years. Ask your legal funding company whether they charge a simple or compound interest rate. Ask them to produce a table showing the interest charges and payments laid out monthly as well as a total of accumulating interest payments over the course of time.

The Lawsuit Funding Company Matters

The first step in applying for legal funding is to understand the Lawsuit Funding Company to which you are applying. Your goal should be to find a company with strong ratings and reputation, that does not balk at your questions and truly wants to partner with you to help solve your financial hardships. Cash For Lawsuits focuses on our clients, first and foremost.

a. We are a direct funder, meaning you do not need to deal with other third parties to provide the financing. Your relationship is with Cash For Lawsuits.

b. We will help you understand the benefits and limitations of your specific situation to clearly communicate what options are available to you as plaintiff.

c. We help to keep your costs as low as possible with our competitively low-use fees and transparency related to repayment and interest rates.

d. We will help you determine the proper amount of your lawsuit cash advance and the best time to take it to keep your costs to a minimum.

Limit The Size Of Your Pre-Settlement Funding

The amount of your pre-settlement funding should correspond to your expected settlement and have the goal to cover expenses for the time period until your case can settle. Pre-settlement funding is really a bridge to allow your attorney the time needed to achieve the highest possible settlement for you as the plaintiff. Taking too much up-front can lead to potential issues should your settlement come in under the expected amount. As a general rule, try to stick to 10-15% of your expected settlement and not the maximum you may qualify to take.

Legal Funding Is Not Always An Option

Rules and regulations and the case types that are eligible for lawsuit funding can vary within regulatory bodies such as a state and the lawsuit funding companies themselves. There are simply some case types that a state will not allow or a funding company does not feel comfortable underwriting as a general operating policy. In addition, the complexity of your case can also deter companies from advancing funds as the risk may be too high. Cash For Lawsuits can assist you to understand what may be allowable in your state and can assess your case to help you determine the likelihood of receiving lawsuit advances.

Let Cash For Lawsuits Help Your Today

The process does not need to take an eternity. Cash For Lawsuits has the experience and the reach to fund nationally. We have a strong network and partnership. In situations where we cannot fund in particular states, we have partners and connections within those marketplaces that can help you.

Call us today or apply below to find out more.

*Required Field